Making money while you sleep sounds like a dream.

But it’s totally possible with passive income!

Whether it’s earning from rental properties, royalties from creative work, or online side hustles, there are plenty of ways to let cash flow in while you snooze.

This guide breaks down options that take some upfront work but pay off long-term.

Imagine waking up each day with your income growing just because you set up a few smart systems.

Dive in, explore what suits you, and start building a path to financial freedom—all while you’re getting that sweet sleep.

Too Many Choices?

Start here instead. Punch in your name and email below I’ll show you step-by-step how to add $500 to your bottom line.

Join the Free 5-Day $500 Challenge

You’ll also receive my best side hustle tips and weekly-ish newsletter. Opt-out anytime.

1. Invest in Rental Property

Investing in rental property is like putting your money into a steady, cash-generating machine.

Buy a property, rent it out, and watch the income come in monthly.

Sure, it requires an upfront investment and a bit of management, but it’s all worth it.

With tenants paying rent, your property can cover expenses, build equity, and bring in extra income on top.

And the best part?

The property’s value can grow over time, increasing your overall wealth.

If managed well, rental income becomes a reliable passive income stream, turning bricks and mortar into monthly cash flow.

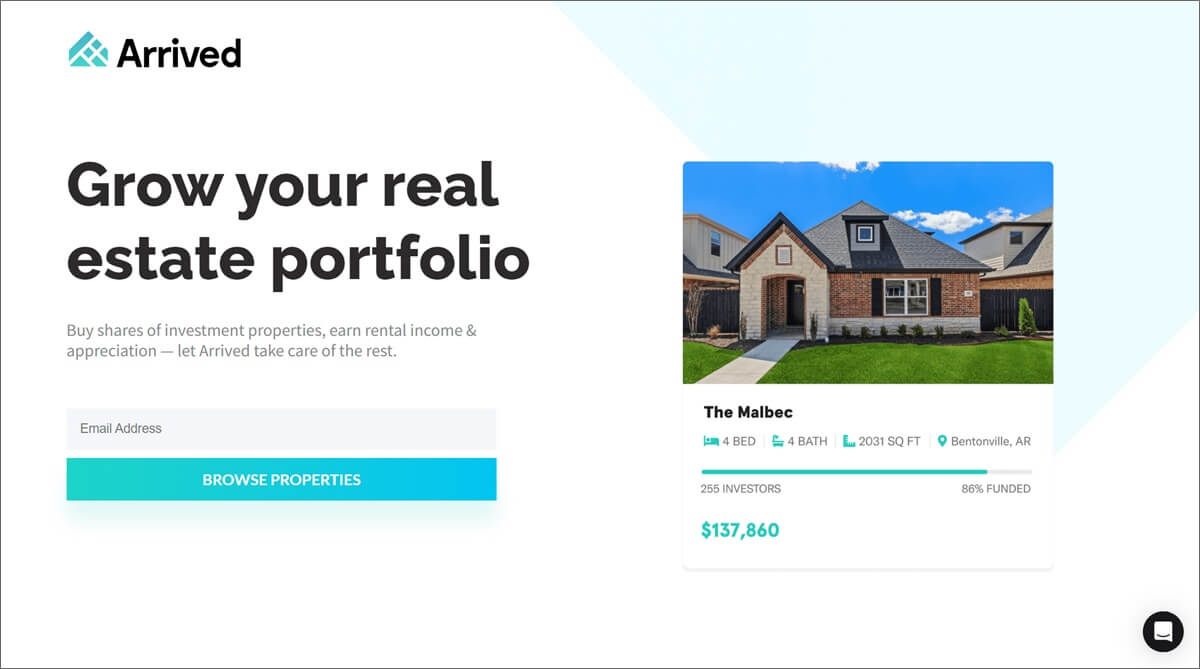

Arrived | Cash Flowing Rentals

4.5

- Earn quarterly dividends

- Completely hands-off

- Low minimum investment ($100)

- Limited liquidity

- Not super diversified

- Listings can sell out quickly

2. Vending Machine Business

Starting a vending machine business is like setting up tiny, 24/7 cash stations.

You pick high-traffic spots—offices, gyms, schools—and stock your machines with snacks, drinks, or even unique items like tech accessories.

Once they’re filled, these machines practically work for you, making passive income with every sale.

The real upside?

Low maintenance and flexibility.

Check on them weekly, refill as needed, and collect your earnings.

You can start with one machine, then expand as you go.

Each one becomes its own little income stream, bringing in cash whenever someone needs a snack fix or quick pick-me-up!

Want more details on how to start your vending machine business?

Watch the interview below…

3. Affiliate Marketing

Affiliate marketing is like getting paid to recommend products you already love.

Here’s how it works: you partner with companies and get a unique link for their products.

Every time someone buys through your link, you earn a commission.

Easy-peasy.

The best part? Once you’ve shared that link, you’re done.

People can click and buy anytime, day or night, while you’re out — or even when you’re asleep.

It’s the ultimate set-it-and-forget-it way to bring in passive income.

I got my start in affiliate marketing back in 2004, and it’s been a significant piece of my revenue pie ever since.

This site (and yes, this post as well!) includes affiliate links to products, apps, services, and software I think will be helpful to my audience.

4. Launch a YouTube Channel

Launching a YouTube channel (here’s mine!) is like creating your own TV show, except you call the shots.

Pick a topic you’re passionate about, from travel tips to gaming reviews, and post videos.

The magic of YouTube?

Once a video is up, it can earn you ad revenue for months—even years!

People watch while you sleep, and ad dollars keep rolling in.

Plus, once you grow your audience, you can score brand deals and sponsorships, adding more passive income streams.

With time and consistency, your channel can become a steady earner that works while you’re chilling.

5. Build an App

Now, this one might be a little too technical for some, but creating an app is like building your own little money-making machine.

Think of something people need—whether it’s a habit tracker, a budgeting tool, or a fun game.

Once the app is live and growing, every download brings in cash, and it’s working for you even when you’re asleep.

With options like in-app purchases, ads, or subscriptions, you can keep the income flowing.

The best part? You only build it once, and it can keep paying off for years.

If people love it, they’ll keep coming back, and your app becomes a hands-off way to make passive income.

Past interviews I’ve done with app creators include Alex Genadinik (got 100,000+ app downloads) and Benny Hsu (made over $30,000).

6. Create Online Courses

Online courses are a brilliant way to turn your expertise into passive income.

Pick something you know inside and out—whether it’s baking, business, or photography—and break it down into easy lessons.

Upload it to a platform like Udemy or Skillshare, and let the students roll in.

Once it’s set up, there’s little upkeep.

Your course can reach people worldwide, earning you income while you sleep, travel, or work on new projects.

Plus, with reviews and shares, your reach grows, bringing in even more students over time.

Teaching once, earning forever—that’s the magic of online courses.

If you want to see some course examples, you can check out our online courses.

7. Invest in Digital Real Estate

Digital real estate is all about owning online spaces that make money for you.

Think websites, domain names, or even social media accounts.

Once they’re set up and gaining traffic, you can earn through ads, affiliate links, or even renting space to other businesses.

For example, my brand now includes a podcast, YouTube channel, and this website.

Buy a promising domain, build a niche website, or start an Instagram page that attracts followers.

If you don’t want to build something from scratch, you can purchase one of these assets on a marketplace like Flippa.

Stacy Caprio used Flippa to acquire a portfolio of income-producing websites.

Over time, as more people visit, the income can start snowballing.

In addition, we use social media and email marketing. All of these connect and each platform helps to build and grow the others.

With some upfront effort, your digital “properties” can keep earning long after you’ve moved on to new projects.

8. Invest in Dividend-Paying Stocks

Dividend-paying stocks are the ultimate way to make your money work for you.

You buy shares in solid companies, and they thank you with regular payouts—called dividends.

It’s like getting a paycheck from your investments without lifting a finger.

They’re typically very mature companies and household names you’d recognize, like Pepsi, Exxon Mobil, and Chevron.

All you need is a brokerage account like E*TRADE or Fidelity.

And as long as you hold onto those stocks, the dividend income keeps coming.

Some companies even increase dividends over time, meaning your income can grow while you’re off doing other things.

And if you reinvest those dividends? You’re setting yourself up for even more passive income.

It’s wealth-building while you sit back and watch it happen.

9. Write an eBook

Writing an ebook is a brilliant way to turn your knowledge into passive income.

Have tips on budgeting, fitness, or life hacks?

Put them into an ebook and publish it on platforms like Amazon Kindle or your website.

Once it’s out there, people can buy it anytime—while you’re asleep, on vacation, or sipping coffee.

After the initial work, the ebook keeps selling on its own.

Each purchase puts money straight into your account without any extra effort.

It’s a one-time project that keeps paying you back, making it perfect for building passive income.

10. Start a Blog

Starting a blog is like planting a money tree—it takes tons of work upfront, but it can grow into a steady income source.

Blogging isn’t an instant cash machine. You’ll need to create great content, build an audience, and stick with it.

But once your blog gains traction, it opens doors to:

- ad revenue

- affiliate partnerships

- sponsored posts

- even your own paid products

A successful blog can earn for years, even when you’re not updating it as much.

My blog is one of my biggest income streams.

With dedication, a blog can become a reliable stream of passive income and something uniquely yours.

11. Commercial Real Estate

Can’t invest in a rental property just yet?

Crowdfunding real estate is like getting a slice of the property pie without buying the whole thing.

You invest a small amount into a property — as little as $10 — through platforms like Fundrise, joining others to fund big real estate projects.

Disclosure: I’m a long-time Fundrise investor and affiliate partner. When you join through my referral link, I earn a commission. Opinions are my own.

(If you’d like more info, check out my Fundrise Review).

Once the project’s up and running, you start earning your share from rental income or property value growth.

It’s truly passive—no tenants, no toilets, no late-night calls.

Just set it, forget it, and watch the returns roll in over time.

It’s a low-stress way to dip your toes into real estate and make your money work while you relax.

Fundrise

4.0

Fundrise is one of the best and largest crowdfunded real estate investment platforms, with $7B under management. The company makes institutional quality investments available to everyone, starting at just $10.

- Start with just $10

- Quarterly cash flow

- Instant diversification

- Healthy historical performance

- Lower volatility

- Liquidity

- Not as diversified as public REITs

- Limited operational track record

- Weaker upside

12. Rent Out Unused Space

Got an empty room, garage, parking space, pool, or basement?

Turn it into cash by renting it out!

People are always looking for storage space or a short-term rental, and you don’t have to lift a finger once it’s set up.

List your space on platforms like Airbnb for guests or Neighbor if you just want storage renters.

While it takes a bit to get everything ready (like cleaning and making sure it’s secure), the rest is passive.

Once you’ve got someone in, that’s monthly income with almost zero extra work—money that rolls in while your space is just… sitting there.

Check out our full Neighbor.com review to learn more.

13. Design and Sell Custom Merch

Designing and selling custom merch is a creative way to earn passive income.

Got a knack for clever designs or funny slogans?

Put those ideas on T-shirts, mugs, or even stickers, and sell them online through sites like Printful.

You don’t need a huge investment, either; these platforms handle printing, shipping, and customer service.

Once your designs are up, they’re out there, ready for anyone to buy.

Each sale earns you a commission, and you can keep adding new designs anytime.

With good marketing, your merch can be a steady source of income while you sleep!

14. Share Your Internet Connection

Sharing your internet connection is an easy way to earn passive income with minimal effort.

Certain apps, like Honeygain and PacketStream, allow you to share a portion of your internet bandwidth in exchange for cash.

Here’s how it works:

These companies use your unused internet connection for data aggregation purposes, like price comparisons, ad verification, or testing app functionality.

Once you set it up, the app runs in the background, letting you earn without any extra work.

Earnings depend on your location and internet speed, so results can vary.

Just be sure to check the app’s security policies and terms so you’re comfortable with the setup.

This income stream won’t make you rich, but it’s a low-effort way to make extra cash while your internet works in the background.

15. Create a Newsletter or Membership Only Community

Creating a paid newsletter or membership community is like building a club where people pay to hear from you.

If you’re knowledgeable in a niche—like business tips, fitness, or travel insights—this is a great way to monetize your expertise.

Platforms like Substack or Patreon make it easy to charge subscribers for exclusive content.

Once it’s up and running, your content reaches members automatically, bringing in steady passive income.

Plus, as your subscriber list grows, so does your income.

It takes some effort to get started, but over time, this can become a rewarding, low-effort revenue stream.

16. Open High-Yield Savings Accounts

A high-yield savings account is the classic route to passive income, and it’s as simple as it gets.

You stash your money, and it grows with interest—usually higher than a typical savings account.

These accounts are perfect if you want risk-free income without much fuss.

Many online banks offer high-yield options, sometimes around 4% annual interest.

No fancy tricks or stock market stress—just good old-fashioned savings, with a modern twist.

Over time, those interest payments add up, bringing in extra income for you.

17. Peer-to-Peer Lending

Peer-to-peer lending is like playing the bank, but with way less hassle.

Here’s the idea:

You lend money to individuals or small businesses through platforms like Prosper.

They pay you back over time, with interest of course — current rates are more than 5%

So, you’re essentially earning passive income as borrowers make their payments.

It’s a little riskier than traditional savings, but the returns are often higher.

You can usually start with a small amount and diversify by lending to multiple borrowers.

Once your funds are out there, you’re just watching those monthly payments roll in.

It’s a unique way to grow your money while you sit back and relax.

18. Leverage Your Car

Why let your car sit idle when it could be earning for you?

Renting it out on platforms like Turo lets you pocket cash whenever you’re not using it.

(Check out our Turo Review)

Or, if you’re driving often, turn it into a rolling billboard with services like Wrapify.

They’ll pay you just to cruise around with ads on your car.

Both options bring in cash without much work.

For rentals, you can set your own availability, while ads just stick around as you go about your day.

It’s simple: less idle car time, more money rolling in.

Turo

3.5

Make $50-150/day renting out your car or truck. Turo helps protect you with up to $750k in liability insurance.

- Strong daily earning power.

- Set your own flexible calendar availability.

- Different insurance options.

- Logistically challenging.

- Accelerates vehicle depreciation.

- Mixed reviews on Turo customer support.

19. Rent Out Tools

Got a power washer, snowblower, or fancy espresso machine just collecting dust?

These are rental gold!

People need these high-ticket items occasionally but don’t want to buy them, and you can rent them out instead.

Platforms like Fat Llama make it easy to list your items for rent with insurance included, giving peace of mind to both you and the renter.

Whether it’s a lawn aerator in spring or a dehumidifier in summer, each rental brings in cash without lifting a finger.

It’s a smart way to turn seldom-used stuff into steady passive income.

20. Dropshipping

Dropshipping is a hands-off way to sell products online without ever touching inventory.

Here’s how it works:

You list products on your site (think cool gadgets or trending fashion).

When someone buys, your supplier ships directly to the customer.

No storage, no shipping, no hassle for you.

Your job is just finding items that sell and handling customer service. Meanwhile, the supplier does the heavy lifting.

Once set up, sales can roll in anytime, turning your site into a passive income generator.

The downside is you have very little control over the fulfillment experience.

21. Sell Stock Photos & Videos

Selling stock photos is like turning your camera roll into a money-making gallery!

Got a knack for capturing great shots?

Upload them to stock photo sites like Shutterstock and Pond5.

Every time someone downloads one of your photos, you get paid—again and again.

It’s totally passive: shoot, upload, and let the royalties roll in.

And it’s not just scenic landscapes; everything from office scenes to weird textures can sell.

The demand for fresh visuals is constant, so the more you upload, the more opportunities you have to earn.

It’s art that works for you, even while you’re snoozing!

Warning: as AI continues to chew up the world, it’s getting better at generating photos and videos. So move forward cautiously.

22. Create Your Own Handmade Products

Creating your own product is a fun way to make some side income—and handmade goods are hot right now!

Pick something simple and easy to replicate, like candles, jewelry, or soap.

The trick? Make a batch all at once, so you have a stockpile ready to go.

Once you’re set up, you can sell them online on platforms like Etsy or at local markets.

With your products already made, each sale becomes practically passive.

As customers order, you just ship out what’s already done.

It’s a creative hustle that keeps paying off, long after the crafting’s done!

23. Buy a Local Business

Buying an established local business or a franchise can be the ultimate income generator with minimal daily involvement.

Whether it’s a laundromat (like Jono in the video below), coffee shop, or car wash, look for something steady where systems and staff are already in place.

With a franchise, you get the added boost of a well-known brand, proven business model, and training—giving you a shortcut to profitability.

The secret to keeping it hands-off?

Hire a reliable team, set up a good manager, and let them handle the grind.

You can simply check in occasionally, keeping a light hand on operations.

Done right, this approach lets you enjoy steady passive income backed by loyal customers and trusted brands.

It’s local income, minus the heavy lifting—earning while someone else handles the details.

24. Wind Farm Leasing or Solar Projects

Leasing land for a wind farm is a clever way to make passive income—especially if the turbines are already spinning.

Here’s the deal:

Energy companies need open land to install wind turbines or solar panels, and they’ll pay good money to lease yours if it meets their criteria.

Once the setup’s done, there’s minimal involvement on your part.

You can work with a company like Landgate to help connect you with the right companies for the leases.

Here’s one of the testimonials listed on their website:

Our son Brad Belser was able to list one of our Fulton County, IL properties on the LandGate platform. We very quickly received interest in the property for a solar project from a reputable company. After some due diligence and discussions we were able to execute a solar lease. Without LandGate this process would not have been so easy, thanks to all the folks at LandGate!

And the best part?

These leases often run for many years, providing a stable income stream long-term.

So if you already own a large piece of land but aren’t sure how to generate revenue, this might be a good fit for you.

25. License Your Music

Licensing your music is a genius way to turn your tunes into effortless cash flow.

If you’ve got music that’s polished and ready, you can license it for use in commercials, films, video games, or even YouTube videos.

Sites like Epidemic Sound and AudioJungle do the heavy lifting by connecting creators with your tracks.

Once your songs are listed, they can earn royalties with every use.

You don’t have to chase down payments or handle details—just collect your royalties while your music plays across projects worldwide.

It’s a one-time effort that keeps the income rolling in with every beat.

FAQs

How much can I realistically earn with passive income?

Passive income varies widely, depending on the method.

For example, a successful blog might bring in a few hundred dollars a month, while rental property could generate thousands.

It all depends on the time and resources you’re able to invest upfront.

Do passive income ideas require upfront work?

Yes! Most passive income streams need some initial effort, like setting up a blog, buying property, or creating a product.

Once the setup is done, though, the maintenance tends to be minimal.

Are there risks involved with passive income?

Yes, every method has its risks!

Investments like stocks or real estate involve market risks, while online businesses depend on traffic.

It’s a smart move to diversify and do thorough research before starting.

Conclusion

This stuff is important! Warren Buffett put it best:

“If you don’t find a way to make money while you sleep, you will work until you die.”

Building passive income streams won’t make you an overnight millionaire, but it’s a great way to start building extra cash flow over time.

From creating a blog or renting out your stuff, to hands-off investments like stocks or digital products, there’s an option for everyone.

Just remember, every method needs a little setup and patience, but the rewards can be well worth it.

Start small, find what works for you, and watch those income streams build up.

You’ve got this—get out there and start setting up some solid passive income that works even while you’re catching up on sleep!

Looking for More Side Hustle Ideas?

- Download The Side Hustle Show. My free podcast shares hundreds of side hustle ideas to make extra money.

- Start Your Free $500 Challenge. My free 5-day email course shows you how to add $500 to your bottom line.

- Join the free Side Hustle Nation Community. The free Facebook group is the best place to connect with other side hustlers and get your questions answered.

No responses yet